As a business owner, every dollar counts.

Between rising operational costs, unpredictable electricity prices, and the pressure to “go green,” it’s easy to feel stuck between cost control and future-proofing. You’ve probably looked at solar before. Maybe even got a quote or two. But something held you back – the capital outlay, the uncertainty, the time it takes, or just not knowing who to trust.

Here’s the good news… Thanks to modern energy financing models like Smart Ease Payment Plans, Chattel Mortgages, and Power Purchase Agreements (PPAs), solar and battery storage is no longer a sunk cost. It’s a strategic, low-risk, cash-flow-positive move that you can make today without touching your capital.

Let’s break it down.

“It’s too expensive up front”

Well, not anymore.

Most businesses are surprised to learn that with a Smart Ease Payment Plan:

- You pay nothing upfront

- You get approval in under 5 minutes (for projects under $150k)

- Your monthly repayments are often less than your electricity savings

Think about that: You could be paying less per month while owning your energy, not renting it from the grid.

“I don’t want to lock up cash in solar when I need to grow elsewhere”

Good. You shouldn’t.

You’re running a business. Your cash is better off funding staff, equipment, vehicles, marketing and lavish Christmas parties. Let your solar system pay for itself while you use your capital for real growth.

Whether you:

- Lease the system (fully deductible rental),

- Own it via Chattel Mortgage (and depreciate it), or

- Buy the power via a PPA (great for large systems)

There’s a finance structure to match your cash-flow and tax goals.

“I’m not sure if solar fits my usage”

That’s where custom modelling matters.

We often hear:

“But I use power at night…”

“We’re seasonal, wouldn’t it be a waste?”

“I lease the property, doesn’t that make it harder?”

These are valid concerns. But they’re solvable.

For example:

- Night-based operations (cold rooms, bakeries, bottling, breweries) benefit massively from solar + battery, or systems that offset daytime base load to reduce peak demand charges.

- Seasonal businesses (like farms) can use storage or hybrid systems to smooth out usage and still save year-round.

- If you’re leasing, you can choose a Rental Payment Plan or PPA, which keeps the asset off your balance sheet and lets you offer to buy it out at the end if you stay long term.

There’s no cookie-cutter solution. But with proper modelling and analysis, we’ll find what works for you and your business.

“Electricity is just a cost I can't control”

Not anymore.

With a well-designed solar + battery system, you’re not just saving money, you’re buying control.

- Lock in a portion of your energy at a fixed cost (instead of rising grid tariffs)

- Get independence from grid instability and price spikes

- Improve your site’s resilience (especially critical for cold storage, pumps, or security systems)

What if this became an asset, not a liability?

Let’s say you’re spending $50,000/year on electricity. That’s $250,000 over 5 years!

But what if some of that spend could be redirected into financing solar?

Instead of handing it all to the energy retailer, you could:

- Finance a solar + battery system with $0 upfront

- Reduce your electricity bills from day one

- Own the system outright (or have the option to buy it) once repayments finish

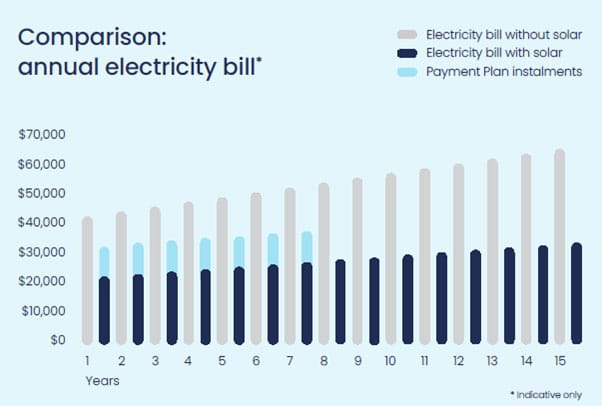

As shown in the chart above:

- In the first 7 years, your combined solar savings and repayments are still less than your old energy bills

- From year 8 onward, your energy costs drop dramatically while the system keeps delivering savings for 10+ more years

This approach gives your business predictable energy costs, stronger cash flow, and long-term savings, all while using money you’re already spending.

Let’s talk tax: You could be missing deductions

Depending on your finance option:

- A Chattel Mortgage lets you claim depreciation and interest

- A Rental Agreement is fully deductible

- If your system (or an upgrade) is under $20,000, it may qualify for the Instant Asset Write-Off

All this adds up to real savings at tax time. We’ll help you and your accountant run the numbers.

Seek independent financial advice to determine whether any of these options applies to your organisation.

"Okay, but what’s the catch?"

There isn’t one, but here’s what you need to consider:

Concern | Reality |

What if I move? | Payment plans can often be novated to the new tenant or owner. |

What if I want out? | You can request a payout at any time – it’s a fixed contract. |

What if something breaks? | You’re covered by product and workmanship warranties. PPAs include maintenance during the term. |

What if I want better terms? | We’ll help you tailor a plan that suits your business needs, not just push one solution. |

Ready to get off the fence?

We get it. Making a change feels risky.

But with:

- No upfront cost

- Clear, fixed monthly payments

- Immediate savings

- Tax benefits

- Equipment ownership options

… the real risk is inaction.

Let us show you what’s possible with a free, no-obligation commercial energy analysis. We'll model your system, finance structure, and estimated monthly cash flow based on your real usage.

Whether you’re a farm, a warehouse, a shopping centre or a small commercial shop, the energy model has changed.

And at OneAU Energy, we’re here to help you change with it.